What is Technical analysis and Difference in Stocks vs Forex vs Commodities

Technical analysis is a method of analyzing and attempting to foresee price movements in financial markets by studying past market data, primarily price and volume, rather than a company’s intrinsic or economic fundamentals. It assumes that all available information is already reflected in market prices and that recognizable patterns and trends tend to repeat because trader behavior is consistent over time. This article is not for financial advice and not a predictions of future price. Just a collection of information .

Definition

- Technical analysis focuses on charts, indicators, and statistics (price, volume, volatility) to identify trends, support and resistance, and patterns that may signal future moves.

- It contrasts with fundamental analysis, which evaluates assets based on earnings, balance sheets, and macroeconomic factors, while technical analysis treats price as the primary expression of supply, demand, and crowd psychology.

- A formal definition describes it as extracting information from market data into visual and mathematical tools to interpret investor behavior and anticipate future price paths.

See also : Fundamental Analysis in Stock and Commodity Market, Fundamental Analysis in Forex Market

Early origins

- Proto‑technical analysis ideas appeared in early markets such as 17th‑century Dutch stock trading, described by Joseph de la Vega, and even earlier commodity trading in Assyrian and Greek markets.

- In 18th‑century Japan, rice trader Munehisa (Honma) Homma at the Dojima Rice Exchange analyzed rice price fluctuations, sentiment, and recurring patterns, creating what became known as candlestick charting; his work is often cited as a foundation of modern technical analysis.

Development in modern markets

- In the late 19th century, Charles Dow, co‑founder of Dow Jones & Company and editor of The Wall Street Journal, systematized U.S. stock market analysis through what became Dow Theory, emphasizing trends, confirmation between indices, and volume.

- In the 20th century, further advances such as Elliott Wave Theory, point‑and‑figure charts, and quantitative indicators expanded technical methods, moving from hand‑drawn charts to computer‑based analysis as data and computing power grew.

Role today

- Technical analysis is now a core tool for traders in stocks, forex, commodities, and crypto, used for timing entries/exits, managing risk, and understanding market sentiment.

- Its effectiveness is debated in academic finance, but it remains widely practiced, especially in short‑term and active trading strategies where price behavior and crowd psychology are central.

Difference in Technical Analysis Between Stocks vs Forex vs Commodities

Technical analysis is widely used across all financial markets, but the way it is applied varies significantly between stocks, forex, and commodities. Each market has its own structure, liquidity pattern, volatility behavior, and influencing forces, which shape how traders interpret charts and technical signals. While many tools—like moving averages, RSI, or trendlines—are universal, their meaning and reliability change depending on the asset class.

This article explains why technical analysis behaves differently in each market, how those differences matter, and what analysts typically pay attention to.

1. Technical Analysis in the Stock Market

Stock markets involve individual companies, sectors, and broader equity indices. Because each stock is a unique instrument with its own business fundamentals, technical behavior varies widely from one company to another.

Characteristics

• Company-Specific Price Behavior

A single earnings report, product release, or CEO news can override any technical pattern.

Charts often show gaps, especially after earnings or overnight news. These gaps become important areas of support/resistance.

• Sector and Index Correlation

Stocks often follow:

- Their sector (tech, energy, financial),

- Broader indices (S&P 500, Nasdaq),

- Risk sentiment.

Technical analysis includes relative strength, comparing a stock’s price to its index.

• Volume is Crucial

Stock volume reveals:

- Institutional accumulation,

- Retail speculation,

- Breakout strength.

Volume-based tools such as OBV (On-Balance Volume), Volume Profile, and Accumulation/Distribution are especially important in equities.

• Trend Duration

Stocks often show longer, smoother trends, especially strong growth companies or defensive dividend stocks.

Why Technical Analysis Differs in Stocks

- Influence of fundamental events (earnings, mergers).

- Large overnight gaps disrupt indicators.

- Volume patterns are highly informative because participants vary greatly.

- Seasonal effects (e.g., earnings season) change chart behavior.

2. Technical Analysis in Forex (FX)

Forex is the world’s most liquid market. Currency pairs reflect macroeconomic cycles, interest rates, and government policy. This creates technical environments unique to FX.

Characteristics

• Continuous 24-Hour Market

Forex rarely gaps except after weekends.

Indicators operate smoothly without major discontinuities.

• Strong Trend Cycles

Forex often trends for long periods due to:

- Central bank divergence,

- Macro themes (inflation, employment),

- Capital flows.

Trend-following tools—moving averages, MACD, ADX, and price channels—are heavily used.

• High Liquidity and Noise

Because FX has massive liquidity:

- False breakouts can occur,

- Price reacts quickly to news,

- Patterns like double tops or triangles may complete more cleanly than in stocks.

• Highly Sensitive to News

Recurring events like:

- Nonfarm Payrolls (first Friday),

- CPI,

- Central bank meetings,

- Interest rate decisions

cause sharp, fast movements.

Why Technical Analysis Differs in Forex

- Fewer gaps mean cleaner indicator behavior.

- Pairs exhibit mean reversion around fair value levels.

- Time-of-day effects are important (London & New York sessions).

- Macro trend cycles allow longer technical themes.

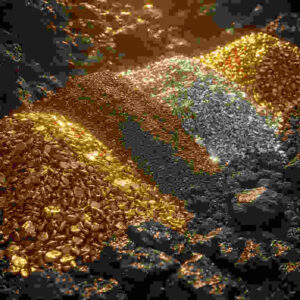

3. Technical Analysis in Commodities (Gold, Oil, etc.)

Commodities are influenced by supply-demand dynamics, geopolitical factors, and inventory levels. Because of this, they behave differently from both FX and stocks.

Characteristics

• High Volatility

Gold reacts to:

- Inflation expectations,

- Bond yields,

- Safe-haven demand.

Oil reacts to:

- OPEC decisions,

- Supply disruptions,

- Global growth cycles.

Price action can be sharp and emotional.

• Strong Reaction to Fundamental Shocks

Large candles occur during:

- OPEC meetings,

- Inventory reports (API, EIA),

- Geopolitical events,

- Commodity-specific news (mining/production updates).

• Trend and Range Phases Are Extreme

Commodities often:

- Trend explosively during supply shocks (e.g., oil embargoes),

- Range for long periods when markets are balanced.

Technical analysis often uses tools like:

- Fibonacci levels (commodity markets respect them strongly)

- Volume profile

- Seasonality charts

- Some may use different method like TD Sequential

• Futures Curve Implications

Backwardation and contango affect:

- Long-term technical momentum,

- Roll-over gaps,

- Price distortions.

Why Technical Analysis Differs in Commodities

- Volatility is structurally higher.

- Price can overshoot due to speculation.

- Seasonal cycles matter.

- Futures expiration creates recurring chart patterns.

4. Key Comparative Differences

| Aspect | Stocks | Forex | Commodities |

|---|---|---|---|

| Gaps | Frequent | Rare | Moderate (due to futures) |

| Major Drivers | Company news | Macroeconomics & central banks | Supply-demand, geopolitics |

| Liquidity | Varies widely | Extremely high | Moderate to high |

| Trend Behavior | Smooth, longer-term | Long macro trends | Violent trends & sharp reversals |

| Session Impact | Exchange hours matter | London/NY sessions dominate | Inventory reports, global events |

| Volume Importance | High | Lower (in spot FX) | High (in futures) |

| Seasonality | Mild | Mild | Strong in many commodities |

5. Why Technical Analysis Must Be Adjusted Per Market

Although many indicators are universal, each market requires adaptation:

Stocks

- Must consider gaps and earnings cycles.

- Volume analysis is essential.

Forex

- Best suited for trend and momentum analysis.

- Time-of-day volatility is key.

Commodities

- Must integrate volatility expectations.

- Seasonal and fundamental shock patterns influence technical signals.

Conclusion

Technical analysis is versatile, but its effectiveness and interpretation depend heavily on the market type.

- Stocks require attention to company fundamentals and volume.

- Forex rewards trend analysis and macro-sensitive tools.

- Commodities demand an understanding of volatility cycles and supply-driven price behavior.

Recognizing these differences helps analysts interpret charts more accurately and understand why markets move the way they do—without assuming that all assets behave the same way.

2 comments