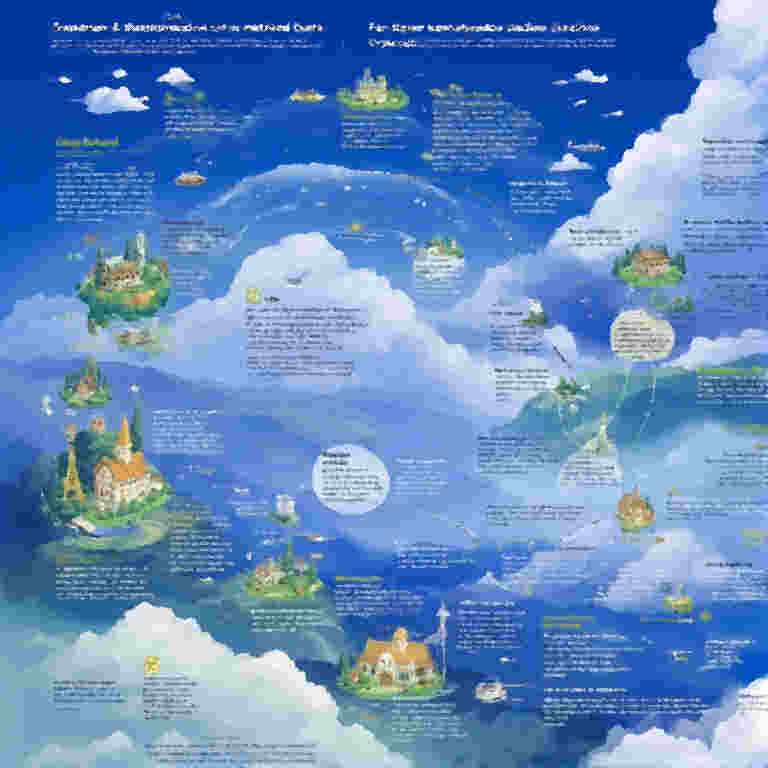

What Factors Affect Gold Price – Explained

Gold has been valued for thousands of years as money, jewelry, and a store of wealth. Even today—long after most countries stopped using gold as currency—its price can swing suddenly. These sharp movements are not random; they come from a mix of economic, political, and market factors. Below are the major influences, explained in simple terms, with real historical examples. This article is not for financial advice and not a predictions of future price.

1. Global Economic Uncertainty

When people fear economic trouble, many shift money into gold because it is seen as safer than stocks or currencies.

Why It Matters

Gold is considered a “safe-haven asset.” During crises, demand rises sharply, pushing the price up.

Historical Example

2008 Global Financial Crisis

When major banks failed and stock markets crashed, gold prices rose quickly as investors moved out of risky assets and into gold.

2. Central Bank Decisions (Especially U.S. Federal Reserve)

Central banks influence interest rates and money supply. These changes can immediately move gold.

Why It Matters

- Higher interest rates → gold becomes less attractive (because it pays no interest).

- Lower interest rates or money printing → gold becomes more attractive.

Historical Example

2020 COVID-19 Crisis

The U.S. Federal Reserve cut rates to near zero and launched massive stimulus programs. Gold quickly surged to new highs as the market anticipated inflation and currency weakening.

3. Inflation and Currency Strength

Gold often reacts inversely to the strength of major currencies, especially the U.S. dollar.

Why It Matters

- When the dollar weakens, gold usually rises.

- When inflation increases, gold is seen as a hedge.

Historical Example

1970s Stagflation

A period of high inflation and weak economic growth caused a massive multi-year rise in gold prices as people sought protection from currency devaluation.

4. Geopolitical Tension and Wars

Events such as wars, political conflict, or unexpected attacks can cause instant fear in markets.

Why It Matters

Uncertainty over global security makes gold more appealing.

Historical Example

Gulf War (1990–1991)

The invasion of Kuwait and subsequent military action triggered a fast rise in gold prices as the world anticipated supply disruptions and conflict escalation.

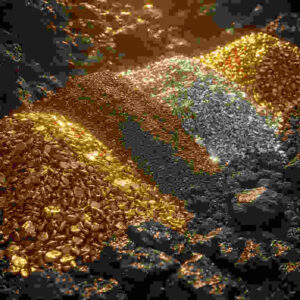

5. Supply and Demand Dynamics

Gold is mined, used in jewelry, technology, and stored by governments. Sudden changes in supply or demand can move prices.

Why It Matters

Mining disruptions, trade bans, or sudden demand for jewelry/manufacturing affect the physical availability of gold.

Historical Example

South African Mining Strikes

As one of the world’s largest gold producers, worker strikes in South Africa during the 1970s and 1980s often caused temporary supply shortages that pushed gold prices upward.

6. Market Speculation & Large-Scale Trading

Price can react sharply when large institutions, funds, or traders make big moves.

Why It Matters

Gold markets are highly liquid, and large purchases or sales can cause short-term spikes.

Historical Example

2013 Gold Crash

A sudden large sell-off in futures markets triggered automatic trading algorithms, causing gold to drop over 10% in just two days—one of the fastest declines in modern history.

7. Technological or Industry Shifts

Changes in technology or industrial demand can influence gold usage.

Why It Matters

Gold is used in electronics, medical devices, and aerospace. Large-scale technological changes can have impact.

Historical Example

Early 2000s Electronics Boom

Rapid growth in phones and computers increased industrial gold demand, contributing to price increases during the 2000s.

8. Government & Central Bank Gold Reserves

Countries regularly buy or sell gold reserves. These decisions can influence global sentiment.

Why It Matters

Government buying increases confidence and demand; selling may signal weakness.

Historical Example

China’s Reserve Announcements (2009 & 2015)

When China announced large additions to its gold reserves, prices rose quickly due to perceived increasing demand.

9. Natural Disasters and Pandemics

Major global shocks affect economic activity and investor behavior.

Why It Matters

Crises usually push investors toward gold due to fear and instability.

Historical Example

COVID-19 Pandemic (2020)

Uncertainty over global health and lockdowns led to one of the fastest increases in gold demand in history, with prices hitting record highs.

Conclusion

Gold remains one of the world’s most reactive financial assets. Its price moves quickly because it represents stability in unstable times. Whether driven by fear, economics, global conflict, or big shifts in supply and demand, these factors may push gold up or down in a matter of hours.

2 comments