Silver in January 2026: What Happened and What May Shape the Rest of the Year

Silver is often described as a metal with two personalities. It behaves partly like gold, reflecting sentiment around uncertainty and value preservation, and partly like an industrial material tied to economic activity. In the first month of 2026, silver’s movement reflected this dual nature clearly. Rather than following a single storyline, silver reacted to a combination of financial expectations, industrial demand signals, and broader market psychology.

This article is not financial advice, only opinion and information in the past and do not predict anything on assets in the future.

Silver Price Movements (January 1 – February 4, 2026, GMT0)

In markets, gold to dollars pairs are known as XAG/USD.

Silver prices since January 1, 2026 (GMT0) have shown a mix of steady gains, sharp corrections, and notable rebounds, with extreme movements occurring mid-January and late January. Overall, silver is trading slightly higher today compared to its opening levels, reflecting safe-haven demand and global market volatility.

- From January 1–5, 2026, silver opened near $28.10/oz and moved modestly upward, closing around $28.35/oz

- by January 5 as investors positioned for the new year.

- Between January 6–10, prices climbed steadily, reaching $28.70/oz, supported by stronger industrial demand signals.

- On January 11–14, silver traded sideways in the $28.60–$28.75/oz range, showing little volatility.

- A notable event occurred on January 15, when silver spiked to $29.20/oz in response to geopolitical tensions, marking its first major breakout of the year.

- However, on January 16, silver dropped sharply by nearly 3%, falling back to $28.30/oz, mirroring gold’s decline after hawkish U.S. Federal Reserve signals.

- From January 17–20, silver rebounded strongly, climbing back above $29.00/oz, with January 19 seeing a 2.5% surge as bargain hunters entered the market.

- The period from January 21–25 was relatively stable, with silver consolidating between $28.90–$29.10/oz.

- On January 26, silver experienced another sharp dip to $28.40/oz, its lowest since early January, before recovering quickly on January 27–28, closing near $29.05/oz.

- The final days of January (Jan 29–31) saw silver hover around $29.00/oz, with minor fluctuations.

- Entering February 1–3, silver traded in a tighter band between $28.95–$29.15/oz, showing resilience despite global uncertainty.

- As of February 4, 2026 (GMT0), silver is holding near $29.05/oz, slightly above its opening price for the year, reflecting cautious optimism among investors.

What Have Been Noted so Far

- Extreme moves: Jan 15 spike to $29.20, Jan 16 drop to $28.30, Jan 19 rebound above $29.00, Jan 26 dip to $28.40.

- Overall trend: Silver began at $28.10 and is now near $29.05, showing net gains despite volatility.

- Drivers: Geopolitical tensions, Fed policy signals, and industrial demand shaped the cycle.

What Happened and What May Shape the Rest of the Year

During January 2026, silver showed noticeable sensitivity to shifts in global sentiment. As markets assessed economic conditions at the start of the year, silver moved in response to changing expectations about growth, inflation, and monetary policy. When uncertainty increased, silver benefited from its association with precious metals and its perceived role as a tangible asset. When optimism returned, industrial demand expectations supported interest in silver. The strength of silver in this period was versatility. It was able to attract attention from different perspectives at the same time. The risk, however, was instability. Because silver reacts to multiple forces, its price movements were often sharper and less predictable than those of gold.

Another factor influencing silver in early 2026 was industrial demand expectations. Silver is widely used in electronics, renewable energy components, and manufacturing. At the start of the year, discussions around technology investment and energy transition influenced how markets viewed future demand. The strength here is real-world usage. Unlike purely financial assets, silver is physically consumed in many industries. The risk is economic dependency. If growth expectations weaken, industrial demand assumptions can quickly reverse, pressuring silver sentiment.

Silver’s movement in January was also shaped by currency dynamics, especially movements in major global currencies. Like other commodities priced internationally, silver often reacts when currency values shift. The strength of this relationship is transparency. Currency changes clearly influence purchasing power and global demand. The risk is amplification. Even small currency fluctuations can lead to larger swings in silver prices.

Looking ahead to the rest of 2026, one important theme likely to influence silver is economic growth balance. Silver tends to benefit when industrial activity expands and confidence improves. The strength of this theme is alignment with real activity. Strong production and investment environments support silver’s industrial role. The risk is fragility. If growth slows unexpectedly, silver can lose support faster than metals with less industrial exposure.

Another major theme for the year is energy transition and technology demand. Silver’s use in solar panels and advanced electronics keeps it connected to long-term structural trends. The strength here is relevance. These sectors are not short-lived themes. The risk is expectation mismatch. Actual demand growth may differ from optimistic projections, creating volatility when reality does not meet assumptions.

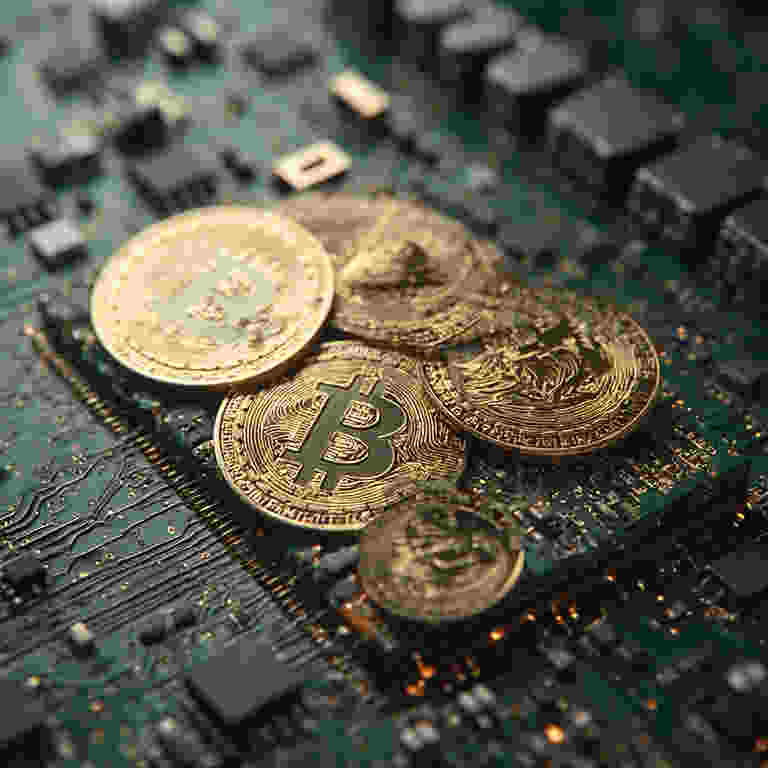

Monetary policy uncertainty may also continue to affect silver throughout 2026. As interest rate expectations evolve, silver’s appeal as a non-yielding asset fluctuates. The strength of silver in this context is optionality. It can respond positively to both inflation concerns and growth optimism. The risk is inconsistency. Silver may react differently to similar signals at different times, confusing expectations.

Geopolitical developments remain another influence. Trade tensions, supply chain disruptions, and political uncertainty can affect both industrial demand and investor sentiment. The strength of silver here is adaptability. It reflects both defensive and growth-related narratives. The risk is emotional reaction. Headlines can trigger exaggerated moves that later reverse.

Finally, market psychology plays an outsized role in silver compared to some other assets. Silver markets are smaller and can react more sharply to shifts in sentiment. The strength of this is responsiveness. Silver quickly reflects changing views. The risk is volatility. Rapid moves can occur without clear fundamental changes.

In summary, silver’s movement in the first month of 2026 highlighted its dual role as both a precious and industrial metal. January reflected shifting sentiment, industrial expectations, and currency influences rather than a single dominant factor. Looking ahead, themes such as economic growth balance, energy transition demand, monetary policy uncertainty, and geopolitical developments are likely to continue shaping silver’s behavior. Silver’s strength lies in its versatility and real-world use, while its risks come from volatility, sensitivity to expectations, and its tendency to amplify both optimism and uncertainty.

See also : The Unspoken Dialogue: When Gold and Silver Part Ways, Bitcoin and Crypto Trends in 2026, Possibilities Landscape of Gold and Silver in 2026

See news : Gold in January 2026: What Happened and What May Shape the Rest of the Year, Crude Oil in January 2026, Forex Pairs in January 2026, Bitcoin in January 2026

2 comments